American Express – Credit Card

Introduction to American Express

Welcome to the world of American Express, where prestige meets convenience in the form of an iconic credit card. With a range of exclusive benefits and rewards, an American Express credit card is more than just a payment method – it’s a lifestyle choice. Join us as we explore the features that make American Express stand out from the crowd and discover how you can elevate your financial experience with this renowned brand.

Free amazon prime and gift card 200$ , collab

Exciting news for all the savvy shoppers out there! American Express is offering a fantastic deal in collaboration with Amazon Prime. When you sign up for an American Express credit card, not only do you get access to exclusive benefits and rewards but also a complimentary Amazon Prime membership.

But wait, there’s more! As a cherry on top, new cardholders can also enjoy a $200 gift card to use on their favorite items on Amazon. It’s like getting rewarded just for treating yourself to something nice – talk about a win-win situation!

With no annual fees and the option of pre-approved limits up to $10,000, this offer is too good to pass up. Whether you’re looking to shop online or in-store, having an American Express credit card in your wallet opens up a world of opportunities.

Don’t miss out on this amazing opportunity – sign up today and start reaping the benefits!

No fees card and pre approved 10k limit option

American E. offers a unique no fees card with the option for a pre-approved $10,000 limit. This feature provides cardholders with financial flexibility without worrying about annual fees cutting into their budget. With this card, you can enjoy the benefits of a high credit limit without the burden of extra charges.

Having a pre-approved limit of $10,000 gives you peace of mind knowing that you have access to funds when needed. It also allows for greater purchasing power and financial security in case of emergencies or large expenses.

This no fees card from American E. is designed to cater to your needs while keeping costs low. By eliminating annual fees, it makes managing your finances simpler and more cost-effective. The convenience of having a generous credit limit ready at your disposal adds an extra layer of convenience to your financial planning.

With American Express’ focus on customer satisfaction and financial well-being, this no fees card with a pre-approved $10,000 limit is ideal for those looking for both affordability and flexibility in their credit card options.

Application Process for an American Express Credit Card

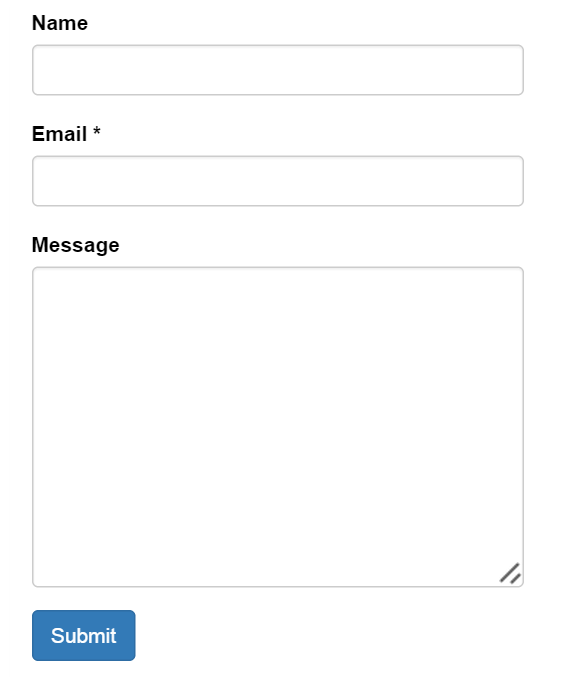

Applying for an American E. Credit Card is a straightforward process that can be completed online in just a few simple steps. To begin, visit the official American Express website and choose the credit card that best fits your needs. Next, click on the “Apply Now” button to start your application.

You will need to provide some basic personal information such as your name, address, income details, and social security number. Make sure all information is accurate to avoid any delays in processing your application. Additionally, you may be asked about your employment status and monthly expenses.

Once you have filled out all required fields, review your application carefully before submitting it. Double-checking ensures that there are no mistakes or missing information that could cause delays in approval. After submitting your application, you will typically receive a decision within minutes.

If approved, you will receive your new American E. Credit Card by mail within 7-10 business days. Activate your card following the instructions provided and start enjoying the benefits of being an American Express cardholder!

Tips for Using an American Express Credit Card Responsibly

When it comes to using your American E. credit card responsibly, there are a few key tips to keep in mind. Always make sure to pay your bill on time and in full each month. This will help you avoid accruing high interest charges and maintain a healthy credit score.

Keep track of your spending by regularly reviewing your statements online or through the mobile app. Monitoring your transactions can help you stay within budget and detect any unauthorized charges promptly.

Another tip is to utilize the rewards and benefits offered by your American Express card wisely. Whether it’s cashback, travel points, or discounts at partner merchants, make sure to take advantage of these perks without overspending.

Be cautious with cash advances on your credit card as they often come with high fees and interest rates. It’s best to use your American Express card for purchases where possible rather than withdrawing cash.

By following these tips, you can enjoy the convenience and benefits of an American Express credit card while maintaining financial discipline.

Conclusion

American E. credit cards offer a range of benefits, from free Amazon Prime memberships to no annual fees and generous credit limits. The application process is straightforward, and with responsible card usage, you can make the most of the rewards and perks that come with an American Express card. By adhering to some simple tips for responsible credit card use, you can maximize your benefits while maintaining financial health. Consider applying for an American Express card today to start enjoying these exclusive advantages!